In November 2017, the U.S. Securities and Exchange Commission’s Division of Enforcement issued its annual report. The report first reviewed the Division’s FY 2017 enforcement results (a brief summary follows in an appendix below). The report also identified five core principles that will guide the Division’s enforcement activity going forward.

Although these guiding principles highlight a slight shift in the Division’s focus, they reinforce that the Division will continue “vigorous enforcement” of federal securities laws. As a result, public companies, auditors, financial firms (investment advisers, investment companies, broker-dealers, private equity, etc.), and individuals remain squarely in the SEC Enforcement’s crosshairs. Several observations and important tips aimed at minimizing risks follow a summary of the Division’s five principles.

Guiding Principles For Fiscal Year 2018 SEC Enforcement

The Division’s report highlights five core principles that will guide enforcement activity going forward. In the coming year, the Division will:

(1) Focus on the Main Street Investor

The Division will focus on pursing misconduct that primarily affects the average, “Main Street” investor. “Retail investors are often not only the most prevalent participants in our marketplace, but also the most vulnerable and least able to weather financial loss,” states the report. The Division thus will prioritize actions that affect retail investors, including “accounting fraud, sales of unsuitable products and the pursuit of unsuitable trading strategies, pump and dump frauds, and Ponzi schemes.”

The Division recently announced the formation of a Retail Strategy Task Force, which will be dedicated to developing strategies and methods to identify potential harms to retail investors. The task force will significantly focus on financial firms and investment professionals, and will coordinate closely with the Office of Compliance Inspections and Examinations and leverage technology and data analytics to identify large-scale concerns.

(2) Focus on Individual Accountability

The Division’s “vigorous pursuit of individual wrongdoers” will be a “key feature” of the Division’s enforcement program. The Division will continue to pursue misconduct by both entities and individuals. Yet the Division has made clear its firmly-held belief that “individual accountability more effectively deters wrongdoing.” The report recognizes that individuals are more likely than entities to litigate the Division’s charges, but nevertheless states “that is a price worth paying.”

(3) Keep Pace with Technological Change

The Division believes that cyber-related threats “are among the greatest risks facing our securities markets.” As a result, the Division formed a Cyber Unit, which combines the Division’s “existing cyber-related expertise and its proficiency in digital ledger technology.” The Cyber Unit will initially focus its efforts on market manipulation schemes utilizing social media; hacking concerns; alleged violations involving distributed ledger technology and initial coin offerings; retail account intrusions; misconduct perpetrated using the dark web; and other cyber-related threats to trading platforms and trading infrastructure.

(4) Impose Sanctions That Most Effectively Further Enforcement Goals

“Sanctions are critical to driving behavior,” states the report, “and we have a wide array of tools available to further our objectives.” These include disgorgement and civil penalties, but also undertakings, monitors, compliance requirements, and admissions. Going forward, the Division will assess the most appropriate “package of remedies” to apply in any individual case. It does not believe in applying a “formulaic or statistics-oriented approach.”

(5) Constantly Assess the Allocation of Resources

The Division said that it will constantly assess its allocation of resources, and whether they are addressing the “most significant market risks and in the most effective manner,” focusing primarily on alleged violators that post the “most serious threats to investors and market integrity.” Such allocation is particularly necessary, noted the report, because of the significant influx of reported concerns - SEC personnel reviewed over 16,000 tips and 20,000 suspicious activity reports last year alone.

Selected Tips and Observations

Since strong enforcement will continue unabated for the foreseeable future, here are several observations and important tips that may help entities and individuals minimize risks:

- Retail and Cyber Mandates May Yield Assertive Enforcement. The Division, and indeed the Commission as a whole, has repeatedly emphasized its focus on the Main Street investor and cyber issues. These focuses are not entirely new, but the recent rhetoric may translate into more assertive enforcement activity in investigations containing a clear retail investor and/or cyber element.

Financial firms of all types should be particularly prepared for increased SEC scrutiny. And the Division has also made clear that its retail and cyber mandates equally justify continued intense scrutiny of public companies and their auditors. All of these entities, and their personnel, thus should proactively refresh compliance efforts, and promptly and appropriately respond to potential concerns.

- Potential Individual Liability is Real. The Division has also gone to great lengths to stress its pursuit of individual accountability. The Department of Justice has likewise publicly demonstrated its commitment to holding individuals accountable for violations of law. (For instance, the DOJ recently extracted guilty pleas from two executives of an oil services company for violations of the FCPA, including for some conduct that predated one executive’s tenure at the company.) Every situation is unique, but entities and their counsel should give serious consideration to separate counsel for individuals who may be involved in potential issues early in the process.

- Possible Opportunities For Proactivity. The Division’s recognition of its limited resources, and apparent appetite for creative sanctions, could suggest that the front-line staff may be more open to discussing evidence, anticipated charges, and even potential resolutions at an earlier stage than in the past. These priorities could also suggest that the Division may seek to very clearly incentivize entities and individuals that engage in proactive self-policing, self-investigation, and appropriate self-remediation. Given the proliferation of potential risks, entities should consider engaging counsel to conduct an efficient, cost-effective, and reliable internal investigation of potential issues.

Conclusion

The SEC’s Division of Enforcement’s recent annual report highlights a shift in its enforcement emphasis, providing entities and individuals with some intriguing opportunities for working with Division staff. Nevertheless, entities and individuals – particularly, public companies, financial firms, auditors, and each of their personnel – remain squarely in the SEC’s view. Proactive, preventative compliance, coupled with prompt and appropriate action when issues arise, remain critical.

Appendix – Fiscal Year 2017 Enforcement Results

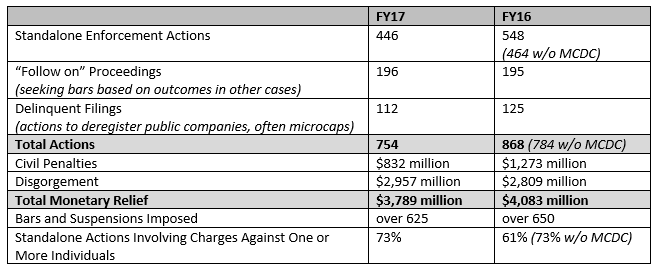

The Division’s report describes the recently-concluded fiscal year (FY17) as “a successful and impactful year for the Enforcement Division.” The overall number of enforcement actions and amount of civil penalties imposed declined in FY17 as compared to the prior fiscal year (FY16). The Division attributes the bulk of the decline to the conclusion of the Commission’s Municipal Continuing Disclosure Cooperation (MCDC) Initiative (a self-reporting program relating to municipal bond offering documents) that led to increased cases in FY16. Other specific metrics are below:

The Division’s mix of enforcement matter types demonstrate general consistency in the Division’s focus, with some fluctuations.

- Issuer reporting/audit & accounting matters comprised a larger percentage of the Division’s standalone enforcement matters in FY17 (21% of the overall standalone actions) than was the case in FY16 (18% of the overall standalone actions).

- Matters involving securities offerings and market manipulation each demonstrated noticeable upticks in both number of cases brought in FY17 versus FY16, as well as in the percentage of standalone cases.

- There was a marked decline in matters involving public finance abuse, again due to the end of the MCDC initiative.

- Actions involving investment advisers, investment companies, and broker-dealers remain a staple of the Enforcement docket comprising approximately 30% of the Division’s standalone actions.

- Insider trading cases also remained a relatively consistent 9% of the docket of standalone enforcement cases, as did FCPA matters at approximately 3% of the docket.

This publication is designed to provide general information on pertinent legal topics. The statements made are provided for educational purposes only. They do not constitute legal or financial advice nor do they necessarily reflect the views of Holland & Hart LLP or any of its attorneys other than the author(s). This publication is not intended to create an attorney-client relationship between you and Holland & Hart LLP. Substantive changes in the law subsequent to the date of this publication might affect the analysis or commentary. Similarly, the analysis may differ depending on the jurisdiction or circumstances. If you have specific questions as to the application of the law to your activities, you should seek the advice of your legal counsel.